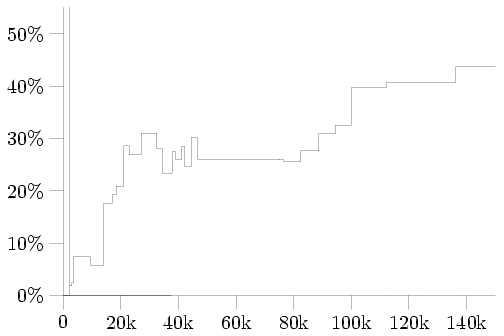

Marginal income tax rates

Like most Canadians, I computed my income taxes in late April. Probably also like most Canadians, I was somewhat surprised by how much tax I was paying on each extra dollar I earned. Unlike most Canadians, I promptly sat down and computed not only my own marginal tax rate, but in fact all of the marginal rates for a hypothetical resident of British Columbia.I started by making some assumptions about said hypothetical taxpayer:

- He/she has a job paying $X/year.

- He/she has no income from other sources (e.g., investments, self-employment, et cetera).

- He/she makes the maximum allowed RRSP contribution, and earned the same income in 2005 (for the purpose of computing the allowed contribution) as in 2006. (Note to non-Canadian readers: An RRSP or Registered Retirement Savings Plan is essentially a tax shelter; income which you put into an RRSP is not taxed until you withdraw it from the RRSP, and while the money is in an RRSP it grows tax-free.)

- He/she was born in 1942 or later (i.e., doesn't qualify for a tax credit due to being over age 65).

- He/she is not married, has no dependents, is not disabled, is not a university/college student, and has made no tax-deductible charitable donations.

- He/she had $2000 of medical expenses in 2006. (Canada has a good public health care system where doctors and hospitals are concerned, but it doesn't provide any pharmaceutical or dental/vision benefits. Many employers provide "Extended Health" coverage which pays for such expenses.)

- He/she is a resident of British Columbia.

I then computed the total of the income-based taxes paid by this hypothetical taxpayer, including

- Federal income tax

- The GST tax credit

- Canada pension plan contributions

- Employment insurance premiums,

- BC Provincial income tax, and

- The BC provincial sales tax credit.

A few interesting points are visible here:

-

Yes, there really is a huge spike in the marginal tax rate at $2000/year

of income. In fact, the spike is larger than the graph shows: Between

$2000/year and $2038.12/year, there is a marginal tax rate of 100%.

This is one of the strangest quirks of Canada's income tax system, and exists as a result of the formula for computing Employment Insurance premiums:

- Employment Insurance premiums are 1.87% of earned income, up to a maximum of $729.30/year.

- As an exception to (1), anyone with less than $2000 of income pays no premiums. [Section 94(4) of the Employment Insurance Act.]

- As a further exception to (1), Employment Insurance premiums will be reduced as necessary to ensure that if a person has $2000 or more of income, their income minus Employment Insurance premiums is not less than $2000. [Section 94(5) of the Employment Insurance Act.]

- Aside from the jumps at $14059.44 and $20950.15, where this hypothetical Canadian starts paying Federal and Provincial income tax respectively, the largest jump in the marginal income tax rate occurs at $100,000/year of income, where RRSP contribution limit is capped (at which point our hypothetical taxpayer can no longer "hide" 18% of his annual income).

-

The marginal tax rate at any point between $20950.15 and $34358.43 of

annual income is higher than than the marginal tax rate at any point

between $46556.10 and $82330.49, and the marginal tax rate between

$27000 and $32388.08 is higher than the marginal tax rate at any other

point below $94525.61 of annual income.

This rather contradicts the notion that Canada has a graduated income tax system; indeed, between $14000 and $88000 of annual income, the system looks very much like a flat tax of 26% -- in fact, if the tax system were changed to be a flat tax of 26% on all income beyond $15000/year, our hypothetical taxpayer would notice his income taxes changing by less than $250 in either direction whatever his income within the $14000 -- $88000 range.

This peculiar behaviour of the marginal tax rates results from a multitude of taxes and tax credits which only apply at low income levels. While the "official" income tax rate (federal plus provincial tax brackets) increases from 21.3% to 39.7% between $20000/year and $90000/year, low income earners pay an additional 6.82% of their income in CPP and EI premiums, and at various points the GST tax credit is phased out at a rate of 5% of income, the BC PST tax credit is phased out at a rate of 2% of income, the BC (income) tax reduction credit is phased out at a rate of 3.6% of income, the federal and provincial medical expense deductions are phased out at a combined rate of 0.639% of income, and the federal Refundable medical expense supplement is phased out at a rate of 5.75% of income; the phasing out of these various credits combines to effectively "level out" the marginal tax rate.

What can we learn from this? First, politicians like to give tax credits to "low income" people, but they all have different definitions of "low income". Second, once they decide someone no longer qualifies as "low income", politicians phase out said tax credits very quickly, with the effect of causing a sharp jump in the marginal tax rate followed by a sharp drop a short time later. Third, and most importantly, politicians prefer to increase complexity than to decrease it -- creating a new tax credit wins far more votes than increasing one which already exists -- and it's only when you step back, do the math, and look at the big picture that you see what's really going on.